is property tax included in mortgage ontario

Contact your mortgage lender to set up tax payments to be included with your mortgage. Terms and conditions apply.

Understanding Mortgage Closing Costs Lendingtree

For example if the market value of your home is 325000 and your municipalitys property tax rate is 15 your property taxes would be.

. Most of the time your lender will collect property tax in your mortgage payment then pay your municipality on your behalf. Get the Best Ontario Mortgage Rates Today. For example a Toronto homeowner with a property valued at 500000 would pay 305507 in property taxes based on the citys rate of 0611013 the lowest on the list.

Some cities may add additional taxes. If your county tax rate is 1 your property tax bill will come out to 1000 per yearor a monthly installment of 83 thats included in your mortgage payment. How Property Tax is Calculated in ON.

However there are some times when this is not ideal. The amount of money they get back for these expenses is calculated as 10 of the eligible expenses claimed. Want to see what homeowners across ontario pay in property taxes on homes assessed at 250000 500000 and 1 million.

If you put down more than 20 you may have the choice to pay property taxes as part of your mortgage or separately. Property Assessments in ON. So our mortgage with BMO includes the property tax component approx 95biweekly payment and this has recently changed to 185bi-weekly payment because its not enough to cover the property tax on the property.

In comparison a similarly-priced home in Windsor which has the highest tax rate of 1818668 would have a tax bill of 909334. The end result is an affordability snapshot that lets you see what an increased a higher or decreased salary and financial obligations could mean to your loan eligibility. Are Property Taxes Included In Mortgage Payments.

Lets say your home has an assessed value of 100000. The amount each homeowner pays per year varies depending on local tax rates and a propertys assessed value. However its important to note that a.

Calculate Compare Mortgage Options Then Contact Our Experienced Agents. If the builder has included the GSTHST in the purchase price then itll automatically be included in your mortgage. 325000 market value of home x 150 property tax rate Property taxes.

If youre unsure of how and when you must pay real estate taxes know that you might be paying them along with your monthly mortgage payments. Dont forget though if you have any questions or would like to make any changes within your current mortgage Im always happy to take the. Hey all been a while since Ive posted but keep reading and learning.

Ad Century 21s Mortgage Calculator Helps Calculate Your Estimated Monthly Mortgage Payments. Property tax included in mortgage payment issue. Ad Americas 1 Online Lender.

Compare Rates Get Your Quote Online Now. Paying property taxes is inevitable for homeowners. For example 10000 spent.

In addition to making your mortgage payments on time your current mortgage lender will mandate that you keep your property taxes up to date. So our mortgage with BMO includes the property tax component approx 95biweekly payment and this has recently changed to 185bi-weekly payment because its not enough to cover the property tax on the property. Whichever option you decide upon will be a personal choice that suits your own needs and lifestyle though typically most homeowners will pay their property taxes through their mortgage as the pros tend to outweigh the cons.

Once your home is paid off youll have to take on the task of paying property taxes yourself. Is Property Tax Included In Mortgage Ontario. ON Property Tax Information.

If your property is not located within a municipality contact the Provincial Land Tax Office in Thunder Bay for questions about your Provincial Land Tax account s payment s tax certificate s or bill s. So you would owe 4875. Ontario administering the property tax is certainly one of the most importantnot least because the property tax is the single biggest source of revenue for municipalities.

Bear in mind this Mortgage Calculator Including Property Tax is not going to include land transfer taxes which may add a great deal to total closing costs. But well get into that later. Once cost often overlooked by both first-time homebuyers and seasoned homeowners is your monthly share of your property tax bill.

Seniors who qualify can claim up to 10000 worth of eligible home improvements on their tax return. Misconceptions about the tax abound and the reforms to the property tax system that began fifteen years ago have yet to be fully absorbed. To pay your property taxes TD collects a share of your annual estimated taxes with every mortgage payment in advanceYou put the portion of your tax money into a separate taxing account from your mortgage.

Once We Can Prove You Ve Received A Similar Level Of Overtime Over The Last 2 Years We Can Then Use That To Add To You Mortgage Tips Financial Services Lenders

Bad Credit Mortgage Ontario Bad Credit Mortgage Best Real Estate Investments Moving Boxes

How To Calculate Your Profit In 2021 When Selling Your Rental Property Mortgage Blog Mortgage Blogs Rental Property Investment Buying Investment Property

Refinancing Flyer Template Instagram Support Services Real Estate Flyers Appraisal

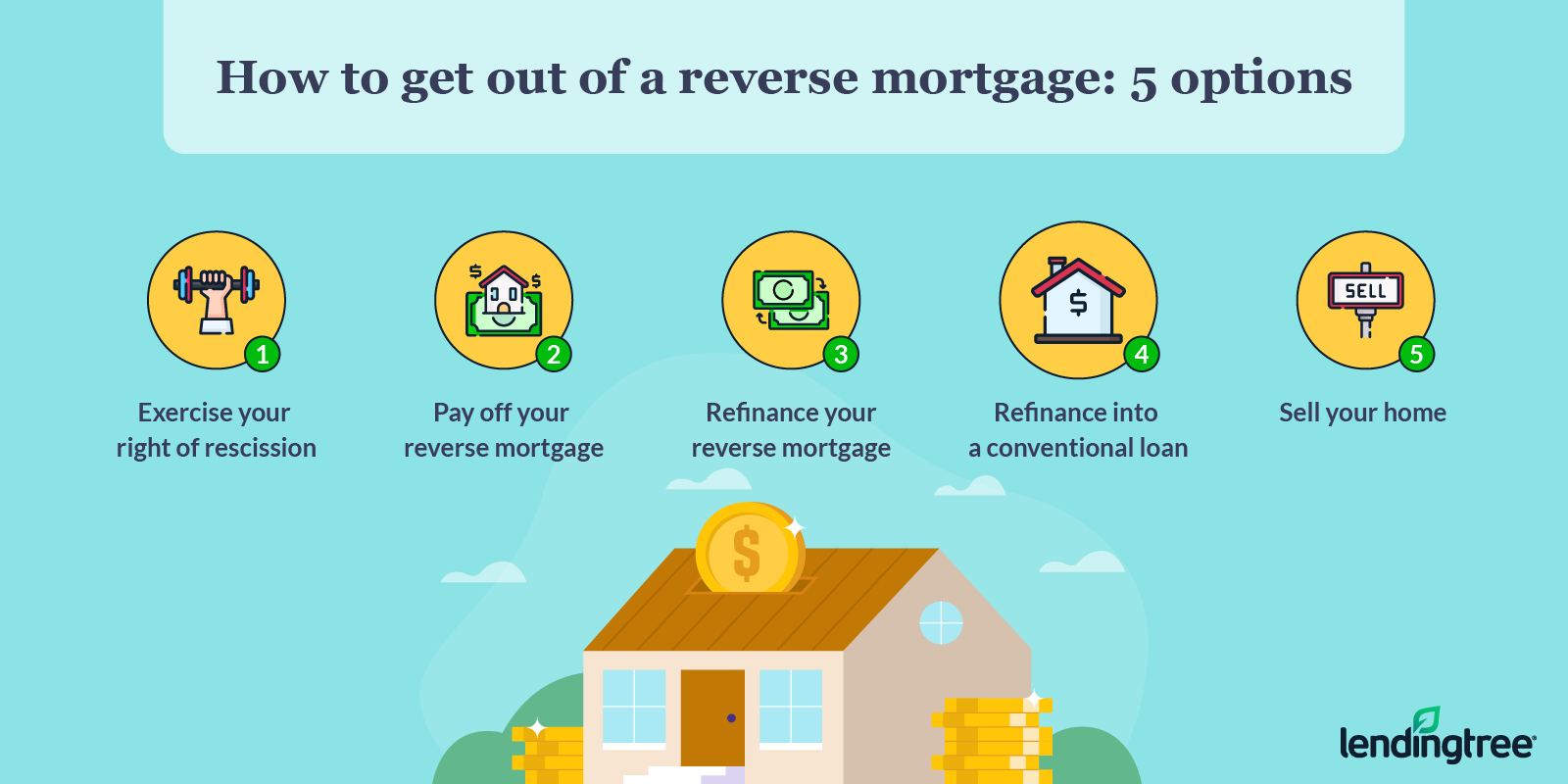

How To Get Out Of A Reverse Mortgage Lendingtree

:max_bytes(150000):strip_icc()/how-many-mortgage-payments-can-i-miss-foreclosure.asp-V1-3e102eda72844d3d86f313001f6c2b73.jpg)

How Many Mortgage Payments Can I Miss Pre Foreclosure

Condo Vs House Current Mortgage Rates Condo Mortgage Rates

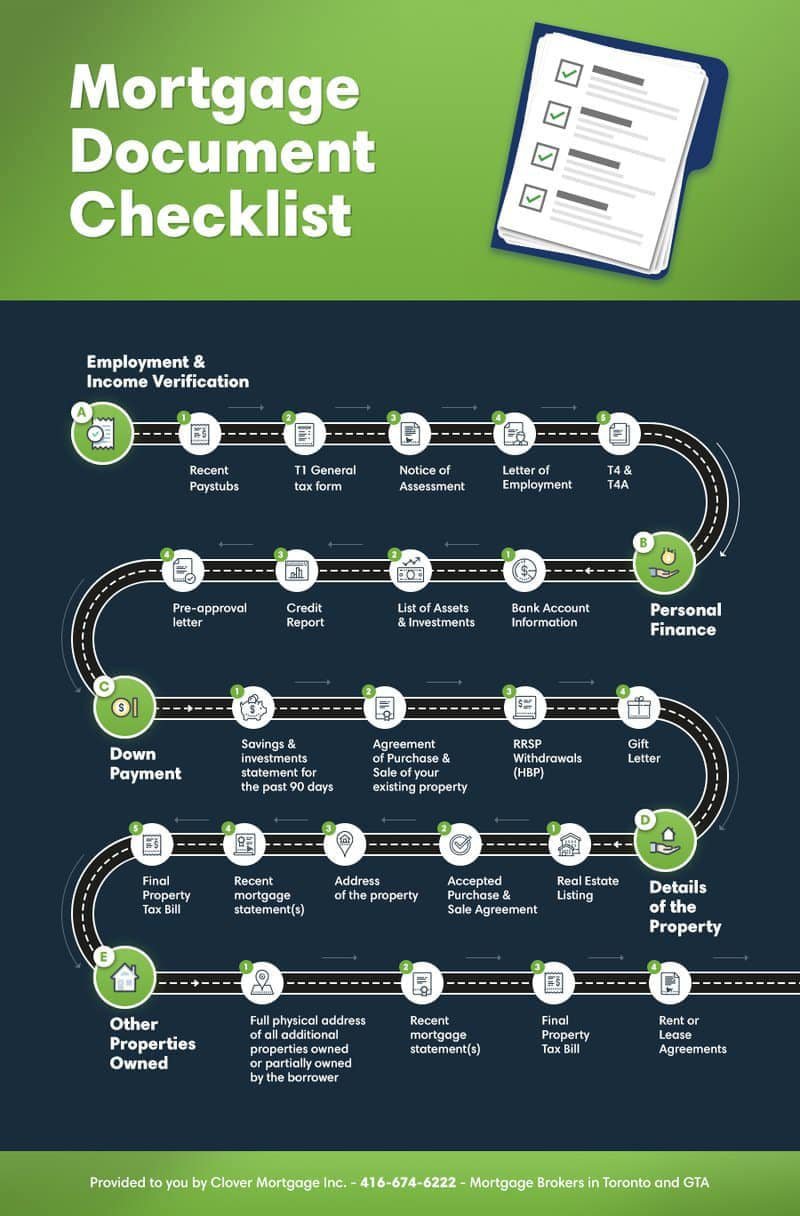

Mortgage Document Checklist What You Need Before Applying For A Mortgage

Should You Pay Property Taxes Through Your Mortgage Loans Canada

:max_bytes(150000):strip_icc()/dotdash-hud-vs-fha-loans-whats-difference-Final-0954708337654015b47b723ebc306b0f.jpg)

Hud Vs Fha Loans What S The Difference

Should You Pay Property Taxes Through Your Mortgage Ratehub Ca

Do I Have To Pay Property Taxes Through My Mortgage Ratesdotca